Zimbabwe Introduces Gold Currency

Has the Government Finally Learned a Lesson?

Back in 2008, the Zimbabwean people were in the midst of an incredible rate of hyperinflation. The government of Zimbabwe eventually gave up measuring the statistic. It was a futile exercise, after all. The rate was accelerating faster than anyone could compute it. It had peaked somewhere on the order of ~80 billion % increase per month!

Of course, the currency became trash. The government stopped printing it. But hey, one man’s trash is another man’s treasure, they say. I, for one, have a few Zimbabwean bills for novelty purposes — a 50 trillion bill and a 100 trillion bill. They couldn’t even buy a pack of gum.

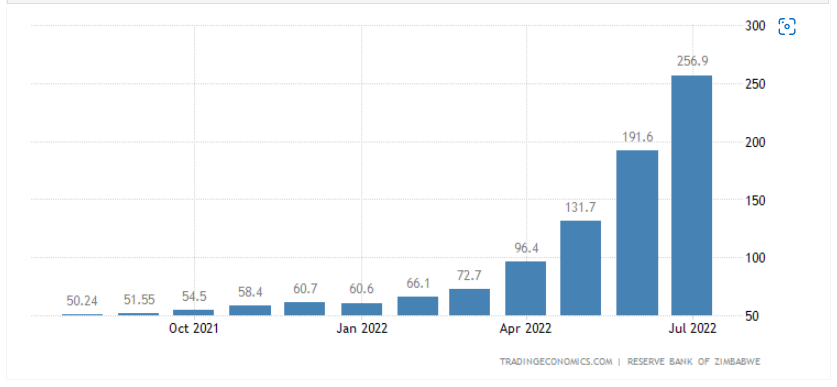

During, and since, that debacle, the Zimbabwean people have turned to use foreign currencies to exchange for survival, notably the US dollar. But then in 2019, the government of Zimbabwe thought they’d give it the ol’ college try once again. They re-introduced a national currency and called it the Real Time Gross Settlement Dollar (RTGS). Maybe they thought a fancy name would fix things. But, the behavior of the government didn’t change, nor their fundamental misunderstanding of money. They continued to destroy the currency, thinking that simply printing the money to finance its operations could magically create prosperity. They didn’t learn from the past. Monetary inflation continues to soar and prices (in Zimbabwean dollars) are to the moon. The July 2022 forecasted yearly price inflation rate is ~257%!1 It is criminal.

Lesson Learned, Yet?

But, the government, led by President Emmerson Mnangagwa, has a new strategy: government-issued gold coins.2 Of course, this is not a new concept. Gold has been the world’s money for centuries; successfully might I add. Even the US Constitution (Article I, Section 10) states that only gold and silver shall be used as legal tender. But you can’t expect a government to follow its own constitution. This would require monetary discipline. What are you, a dreamer?

At the beginning of this month, the Reserve Bank of Zimbabwe released a press statement introducing the gold coins into the market.3

“The gold coin shall be called the Mosi-Oa-Tunya Gold Coin with the following characteristics:

Weight – one troy ounce.

Purity – 22 carats.

Identification – Each coin will have a serial number.

Ownership - Upon purchase, the buyer shall take physical possession of the coin and be issued with a Bearer Ownership Certificate. The buyer or holder of the coin may opt to place it in the custody of bankers of own choice in which case a safe custody certificate/receipt will also be issued.

Liquidity and Tradability - The coin will have liquid asset status, that is, it will be capable of being easily converted to cash, and will be tradable locally and internationally. The coin may also be used for transactional purposes. …

The gold coins will be available for sale to the public from 25 July 2022 in both local currency (ZW$) and United States Dollars (US$) (and other foreign currencies) at a price based on the prevailing international price of gold and the cost of production. …”

It’s not often I cheer on any government policy, but I applaud this one. The challenge will be, as it has historically been, if the government of Zimbabwe and its central bank will be disciplined enough to obey the market price for gold. They will be tempted to set a price relative to its paper currency such that it allows them to continue printing. If they don’t learn their lesson and continue to recklessly print, the paper currency will drive the good money (gold) out of the market and under people’s mattresses, a phenomenon known as Gresham’s Law. Irving Fisher explained this law in his book, The Purchasing Power of Money: 4

“Accurately stated, the Law is simply this: Cheap money will drive out dear money. The reason the cheaper of two moneys always prevails is that the choice of the use of money rests chiefly with the man who gives it in exchange, not with the man who receives it. When any one has the choice of paying his debts in either of two moneys, motives of economy will prompt him to use the cheaper. If the initiative and choice lay principally with the person who receives, instead of the person who pays the money, the opposite would hold true. The dearer or ‘good’ money would then drive out the cheaper or ‘bad’ money.

What then becomes of the dearer money? It may be hoarded, or go into the melting pot, or go abroad,—hoarded and melted from motives of economy, and sent abroad because, where foreign trade is involved, it is the foreigner who receives the money, rather than ourselves who give it, who dictates what kind of money shall be accepted. He will take only the best, because our legal-tender laws do not bind him.

The better money might conceivably be used in exchange at a premium, i.e. at its bullion value; but the difficulties of arranging payments in it, which would be satisfactory to both parties, are such that in practice it is never so used in large quantities. In fact, the force of Gresham’s Law is so great that it will even sacrifice the convenience of a whole nation. For instance, in Italy fifteen years ago the overissue of paper money drove not only gold across the Alps, but also silver and copper. These could circulate in Southern France at a par with corresponding coins there because France and Italy belonged to the Latin Union. Consequently, for a time there was very little small change left, below the denomination of 5 lire notes. Customers at retail stores often found it impossible to make their purchases because they lacked the small denominations necessary, and because the storekeeper lacked the same small denominations, and could not make change. To meet the difficulty, 30,000,000 of 1 lire notes were issued, and these were so much in demand that dealers paid a premium for them. …”

We shall see how this policy pans out. I am excited for the Zimbabwean people, as this is a serious step in the right direction to ending the current and historical misery imposed on them by their own government. When the gold exchanges freely, the people will be free.