The Definition of Inflation

Semantic Distortion Leads Us All to Confusion

This morning, I came across this article titled, “Businesses Have Manufactured Inflation Fear to Protect Profits Amid Rising Wages.” My initial reaction from reading the headline was one of confusion. Businesses manufacturing inflation fear? What?! We have all witnessed the feckless monetary expansion of central banks, the associated fiscal insanity of governments, and the continuing shift of the goalposts by the economic and political establishment. So how could anyone write such a headline? Then I read the article and it became clear. The writer doesn’t seem to understand the fundamental cause of a general rise in prices. I believe this all stems from the misuse of the term “inflation.”

What we hear casually spoken on the street or in the news is that the phenomenon of rising prices throughout the economy is referred to as “inflation.” But, this is not correct.

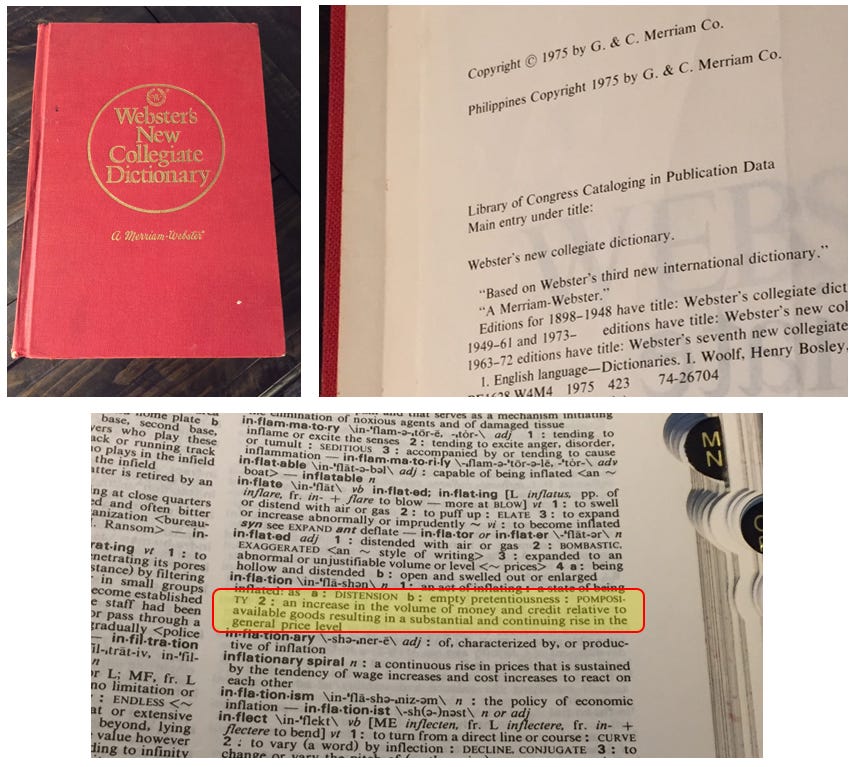

In my personal copy of Webster’s New Collegiate Dictionary (copyright 1975), inflation is correctly defined as, “an increase in the volume of money and credit …”

But today on the internet, the Merriam-Webster dictionary defines inflation as “a continuing rise in the general price level ...” The definition has been completely reversed!

This change in semantics calls to mind the following quote attributed to Napolean Bonaparte:

“History is a set of lies agreed upon.”

Ludwig von Mises in his book, Human Action, said,

“… the semantic revolution of our day brought about a confusion of tongues.”

Mises went on to explain (my emphasis in bold),

“The semantic revolution which is one of the characteristic features of our day has also changed the traditional connotation of the terms inflation and deflation. What many people today call inflation or deflation is no longer the great increase or decrease in the supply of money, but its inexorable consequences, the general tendency toward a rise or a fall in commodity prices and wage rates. This innovation is by no means harmless. It plays an important role in fomenting the popular tendencies toward inflationism.”

This “confusion of the tongues” makes it hard for the layman to understand what’s really going on. The term inflation is now confusingly used to refer to the inevitable consequence of inflation: the tendency of a general rise in prices.

I must admit, I sometimes catch myself feeding this chaos of confusion by using the term carelessly in casual conversation to refer to prices rising. I try to use the terms “monetary inflation” and “price inflation” to better distinguish the two.

This may seem trivial to you, but the result of this confusion is that now there is no term in existence to describe the cause of a general rise in prices. If you can’t even name the problem how are you going to find the solution?!

This brings me back to the article I came across this morning: “Businesses Have Manufactured Inflation Fear to Protect Profits Amid Rising Wages.” In the article, the author states the following:

“The definition of inflation is simple enough: an increase in the prices of goods and services. If prices rise quickly, and outpace wage growth, this can cause problems for working families … But the media narrative about rising inflation has conveniently left out several important points.”

As we see right off the bat, the author gets the definition wrong. In fact, she goes on to acknowledge that prices have been rising for decades, but instead of looking directly at monetary policy as the root cause, she searches for solutions elsewhere.

“First, the prices of some of our biggest expenses — health care, housing, higher education to name a few — have been rising (often explosively so) for decades with little discussion or concern from the punditry. Health care costs are in fact the leading cause of bankruptcy in the country. Global food prices, too, have been rising because of the impact of climate change on crop yields. Easing these kinds of costs — through a nationalized health care system, investment in affordable housing, student debt relief and decarbonization — would go a much longer way toward improving working people’s finances than monetary policies to tighten economic growth.”

And to top off the confusion, she ironically avoids the true “elephant in the room” and says the following:

“Most importantly, the media spin has left out the elephant in the room. It is business owners who are the ones raising prices. They are currently setting record profits, so do they have to raise prices? The answer to this question ultimately reveals that inflation is a question of class politics — which class gains at whose expense — rather than technical monetary policies.”

Whether or not the author is intentionally deflecting blame from the government’s monetary policy onto the millions of businesses around the world is beside the point. The point is that the author’s incorrect definition of inflation from the start has led her to this conclusion.

Now to be fair, the author does go on to at least give the classic explanation for a general rise in prices as “when too many dollars chase too few goods.” But without refuting this, she just quickly turns right back around to attributing the price rise to “good old-fashioned price gouging.”

Ultimately, the author just thinks that inflation should be accommodated by businesses. In other words, just live with it, take it like a champ, stop worrying and learn to love the bomb:

“The question that economic pundits conspicuously avoid is: What if instead of raising prices, businesses just made do with smaller profit margins?”

There are many other points in the article that the author absurdly promotes to fight inflation (e.g., price controls, expanding Medicare and education, rent control, capping pay, taxing the rich). Why does she not strike at the root? Most probably because she doesn’t understand the definition of inflation.