Russia Announces Purchase of Gold at Fixed Rate

Could This Be the Beginning of a Russian Gold Standard?

The US and European governments (and others) are ramping up sanctions against Russia in the wake of Russia’s invasion of Ukraine. The exacerbation of sanctions continues with seemingly never-ending hits, one after another. The Russian ruble has plunged 30% against the US dollar amidst the war and the sanctions. There is a raging “shadow war” being waged through economic means in parallel with the physical war in Ukraine. Nothing good will come of this consistent upward-ratchet of conflict.

The latest punches come with the US Treasury Department now going after companies that allegedly provide goods and services for Russian military and intelligence services. On top of that, further efforts to block the Russian central bank’s ability to use gold have been enacted to prevent Russia from circumventing the sanctions. This effectively bans individuals, gold dealers, and financial institutions from buying, selling or facilitating transactions in gold with anyone Russia-related.

So, what will Putin do in the face of all these sanctions?

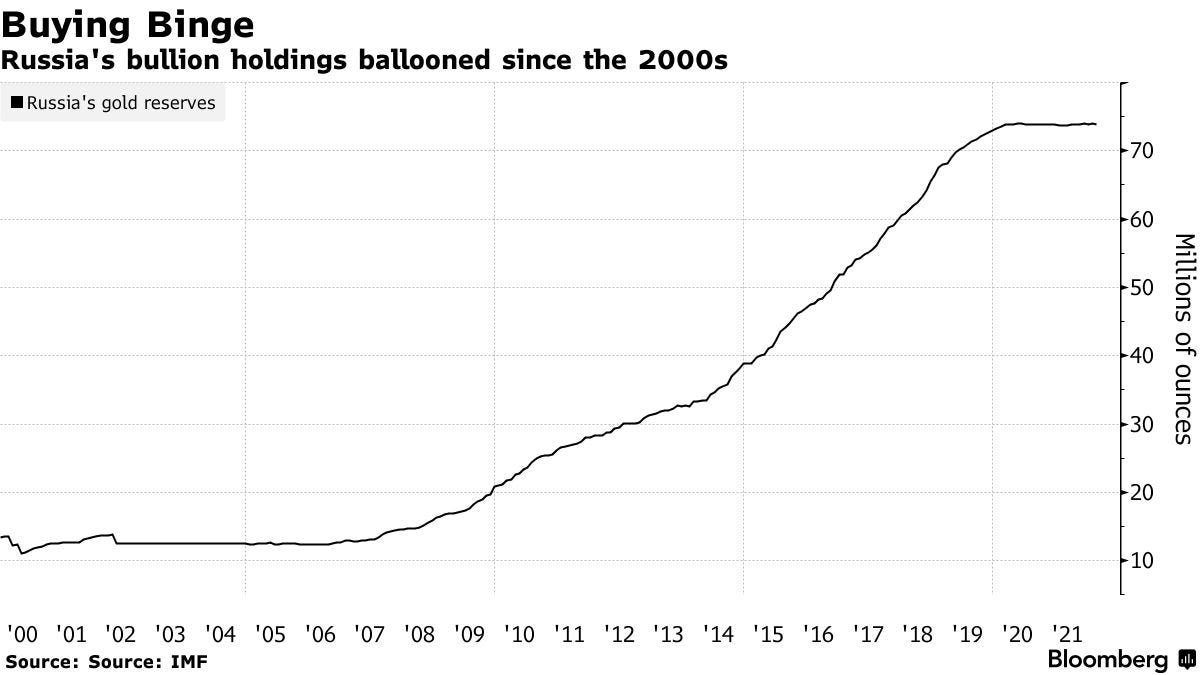

Russia’s Gold Reserves

The Russian government has been building up its gold reserves over the last decade. Currently, the country has the equivalent of roughly $140 billion USD in gold reserves.

It seems Putin understands that gold holdings reduce Russia’s dependence on the petrodollar system. Gold reserves come in handy in crisis situations that Russia finds itself currently in. Russia could swap its gold for non-sanctioned foreign exchange or they could sell gold directly to willing buyers. But, who will risk trading in gold with Russia in the face of the global ostracization campaign?

Well, as financial crises throughout western nations, including the US, seem to be on the horizon, the world may find its desire for gold and gold-backed currencies yet again. Russia is the 5th largest holder of gold reserves in the world. Will Russia be able to weather this storm?

The Start of a Russian Gold Standard?

Russia’s central bank has announced that it will restart its gold purchases, but at a fixed rate of 5,000 rubles/gram. Now this fixed price is below the current market price. So, the obvious question is why would you sell below market?

Well, Russia also aims to increase the amount of loans made by Russian banks. These loans will, no doubt, be paid in rubles. If you have gold and you need rubles, well there you go. So, Russia is perhaps setting the stage to strengthen the ruble with a guaranteed backing — a de facto Russian gold standard. Will the scheme work?

In the context of Europe’s heavy reliance on Russian natural gas, there may be something to this. Western Europe gets ~40% of its natural gas from Russia. Putin is trying to leverage Europe’s dependence on Russian gas by demanding that gas contracts be settled in rubles rather than in foreign currencies. Whoa!

The EU has not banned Russian natural gas, but it has “pledged to reduce Russian gas imports” whatever that’s worth. In late February, the construction of the Russian Nord Stream 2 natural gas pipeline, that would essentially double the feed capacity to Germany from Russia, was halted as a part of the global sanction campaign. This is like Europe shooting itself in the foot to punish the Russians.

If Europe can’t drop its dependence on Russian natural gas, obviously the ruble will benefit. Europe will need rubles. You can get rubles by purchasing Russian gold. Is this going to end up in a shift away from the petrodollar system into a “petroruble” system? Holy moly, it will get interesting.

How will Europe respond? And what about China? We shall see.

I won’t be surprised if we start hearing the governments of the world and their corporate mouthpieces in the press begin to disparage gold and those who hold it. Gold is, after all, the enemy of governments that grow their power through fiat currency inflation. And because the establishment is currently high on “hate everything Russia,” anyone favorable to gold will likely find themselves pulled into the hate campaign through guilt-by-association.

The nations of the world have decoupled their currencies from gold because it hindered their ability to spend without remorse. If a currency is backed by gold, and a government devalues that currency through reckless “money printing,” then investors are motivated to dump the currency and drain the government from their gold holdings. But in the fiat-world we are currently living in, governments have been able to devalue their currencies in tandem with each other for a long time by stealthily hiding the inflationary effects. Any rational person realizes this fiat system is on an unstable path to currency destruction. Governments of the world are facing an unprecedented debt-bubble crisis. And I believe we are now seeing serious impacts from this system becoming widely apparent with considerably high price inflation across the globe.

Can the US government and it’s allies successfully weaponize the current reserve currency of the world (the US dollar) against Russia? Or will the US government kill the dollar first? It’s a race against time.

I’ll leave you with a reminder of what happened to Libya when the Dictator, Moammar Qaddafi, allegedly intended to establish a pan-African currency backed by gold to compete with the French franc and the US dollar. Thanks to Wikileaks, we can all see the curious email from Sidney Blumenthal to Hillary Clinton with the subject line, “France’s Client and Qaddafi’s Gold.” Perhaps the true objectives of the Libyan invasion were not humanitarian at all. That email may have revealed the true ambitions of the invasion of Libya, which is now a modern slave-state as a result.

Thank you for the truth. I'm subscribed now.